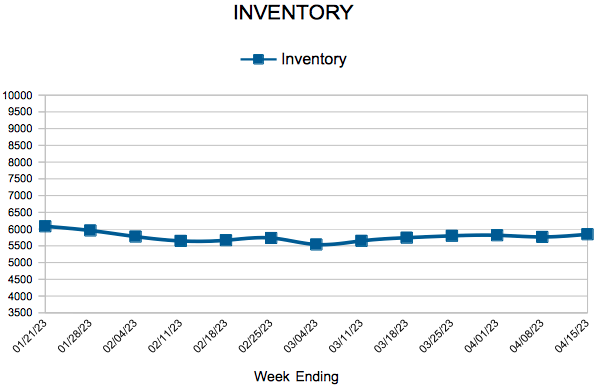

Inventory

Weekly Market Report

For Week Ending April 22, 2023

For Week Ending April 22, 2023

A lack of existing-home supply has allowed U.S. homebuilders to capture a near-record share of housing inventory. According to the National Association of Home Builders (NAHB) Chief Economist Robert Dietz, one-third of current housing supply is new construction, far above the historical norm of 10%. With only 2.6 months’ of existing-home supply as of last measure, prospective buyers have been increasingly turning to the new home market, which, along with builders’ use of sales incentives, have helped support new home sales in recent months.

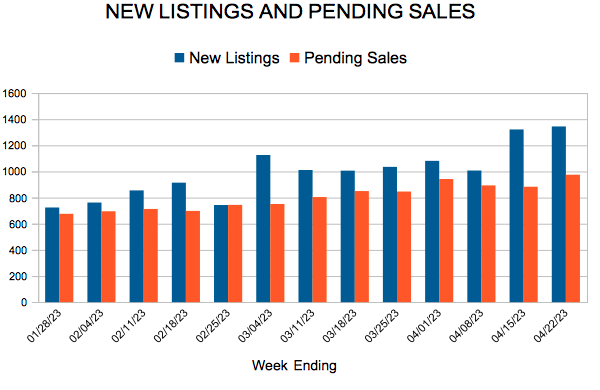

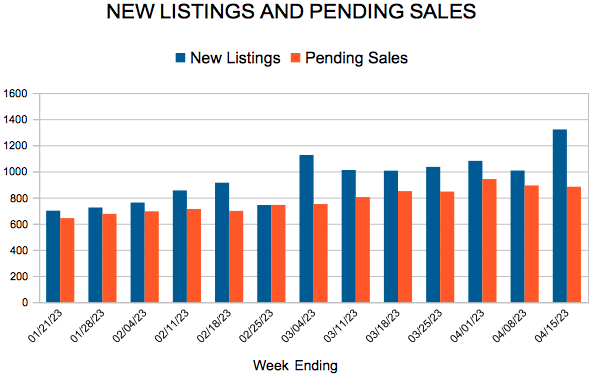

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 22:

- New Listings decreased 27.0% to 1,344

- Pending Sales decreased 17.0% to 975

- Inventory increased 5.0% to 6,065

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

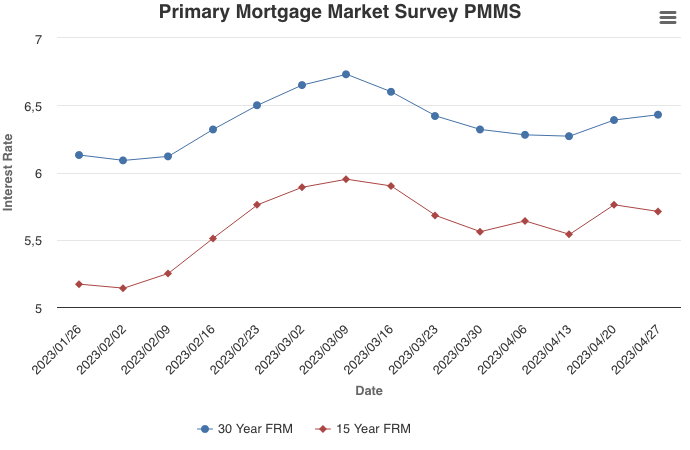

The 30-year Fixed-rate Mortgage Continues to Inch Up

April 27, 2023

The 30-year fixed-rate mortgage increased modestly for the second straight week, but with the rate of inflation decelerating rates should gently decline over the course of 2023. Incoming data suggest the housing market has stabilized from a sales and house price perspective. The prospect of lower mortgage rates for the remainder of the year should be welcome news to borrowers who are looking to purchase a home.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 99

- 100

- 101

- 102

- 103

- …

- 216

- Next Page »