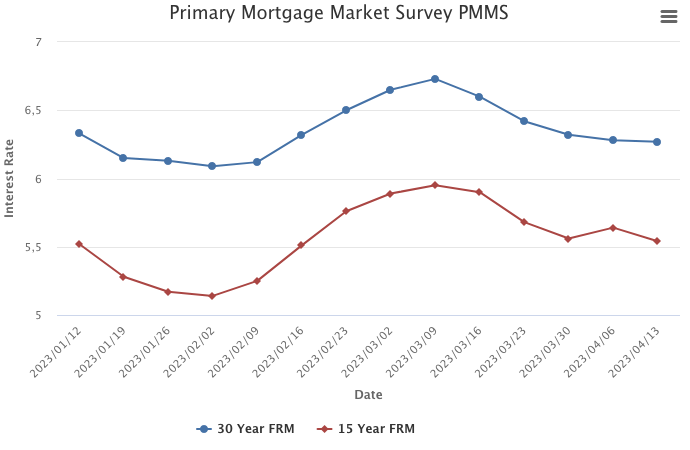

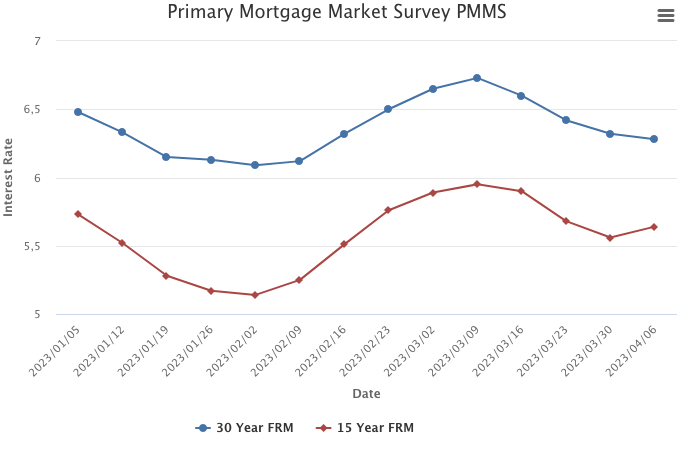

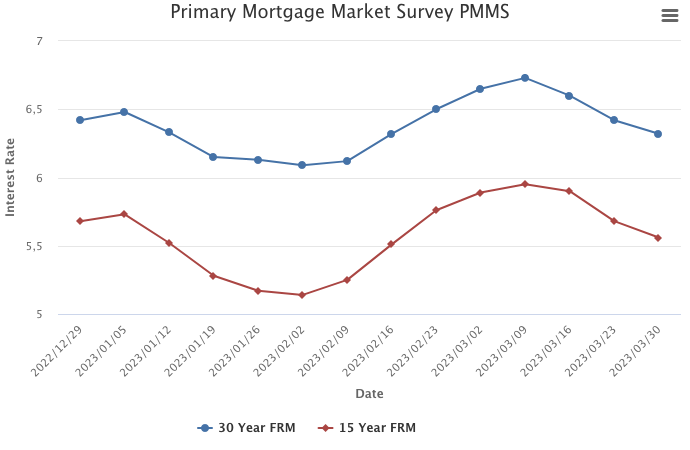

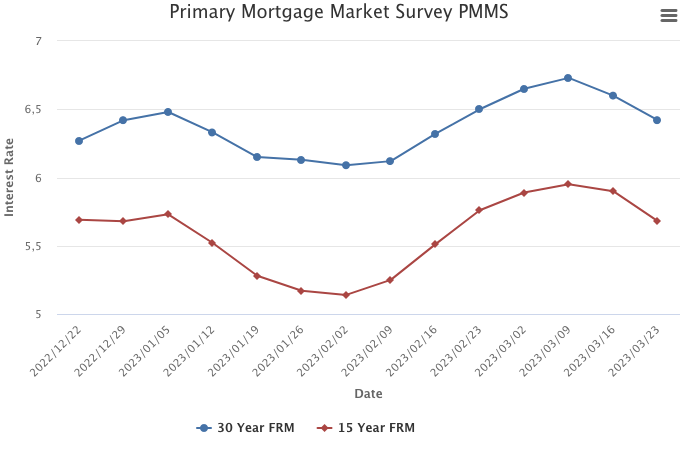

April 20, 2023

For the first time in over a month, mortgage rates moved up due to shifting market expectations. Home prices have stabilized somewhat, but with supply tight and rates stuck above six percent, affordable housing continues to be a serious issue for potential homebuyers. Unless rates drop into the mid five percent range, demand will only modestly recover.

Information provided by Freddie Mac.