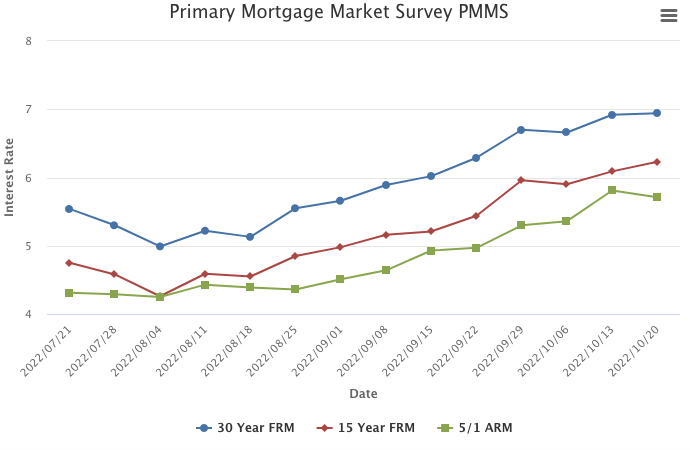

Mortgage Rates Slow Their Upward Trajectory

October 20, 2022

The 30-year fixed-rate mortgage continues to remain just shy of seven percent and is adversely impacting the housing market in the form of declining demand. Additionally, homebuilder confidence has dropped to half what it was just six months ago and construction, particularly single-family residential construction, continues to slow down.

Information provided by Freddie Mac.

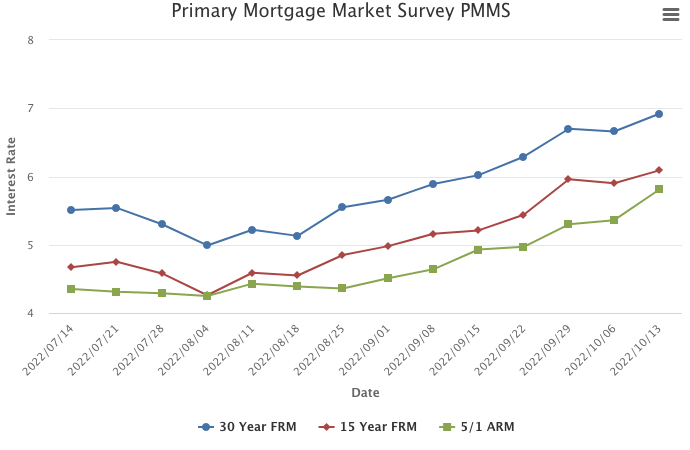

Mortgage Rates Resume Their Climb

October 13, 2022

Rates resumed their record-setting climb this week, with the 30-year fixed-rate mortgage reaching its highest level since April of 2002. We continue to see a tale of two economies in the data: strong job and wage growth are keeping consumers’ balance sheets positive, while lingering inflation, recession fears and housing affordability are driving housing demand down precipitously. The next several months will undoubtedly be important for the economy and the housing market.

Information provided by Freddie Mac.

August Monthly Skinny Video

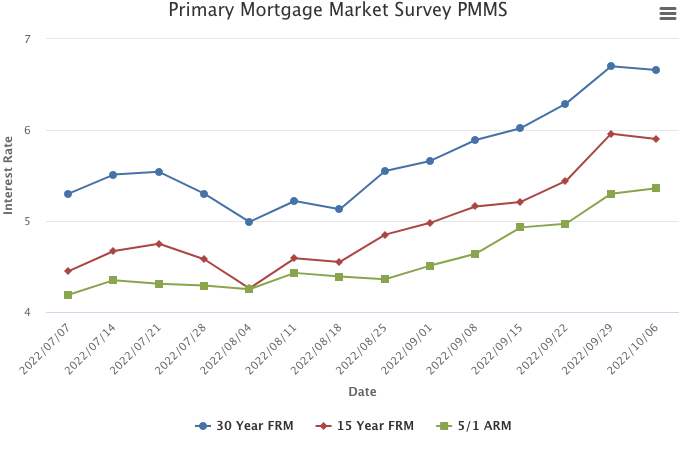

Mortgage Rates Decrease Slightly

October 6, 2022

Mortgage rates decreased slightly this week due to ongoing economic uncertainty. However, rates remain quite high compared to just one year ago, meaning housing continues to be more expensive for potential homebuyers.

Information provided by Freddie Mac.

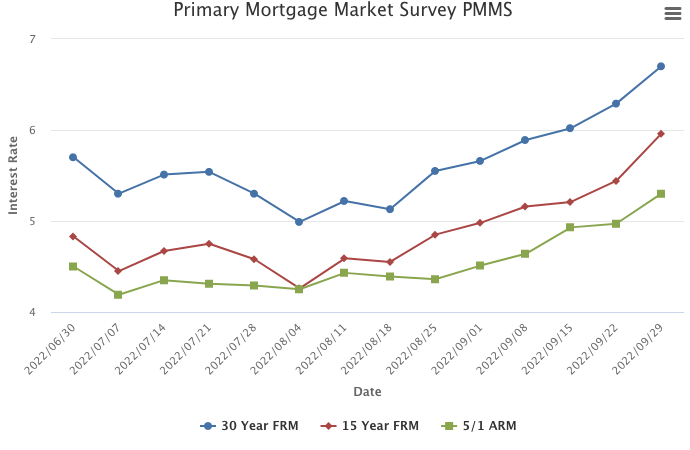

Mortgage Rates Rise for the Sixth Consecutive Week

September 29, 2022

The uncertainty and volatility in financial markets is heavily impacting mortgage rates. Our survey indicates that the range of weekly rate quotes for the 30-year fixed-rate mortgage has more than doubled over the last year. This means that for the typical mortgage amount, a borrower who locked-in at the higher end of the range would pay several hundred dollars more than a borrower who locked-in at the lower end of the range. The large dispersion in rates means it has become even more important for homebuyers to shop around with different lenders.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 25

- 26

- 27

- 28

- 29

- …

- 48

- Next Page »