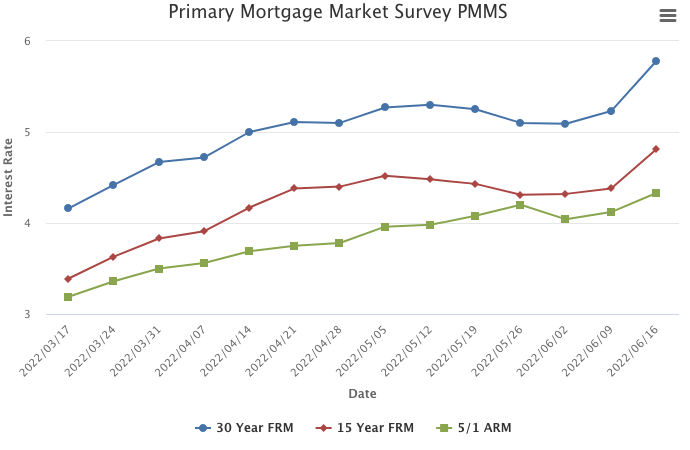

Mortgage Rates Surge on Inflation Expectations

June 16, 2022

Mortgage rates surged as the 30-year fixed-rate mortgage moved up more than half a percentage point, marking the largest one-week increase in our survey since 1987. These higher rates are the result of a shift in expectations about inflation and the course of monetary policy. Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market.

Information provided by Freddie Mac.

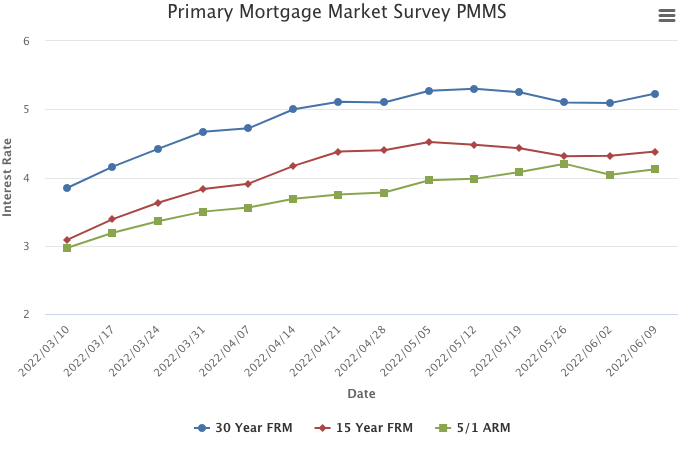

Mortgage Rates Increase

June 9, 2022

After little movement the last few weeks, mortgage rates rose again on the back of increased economic activity and incoming inflation data. The housing market is incredibly rate-sensitive, so as mortgage rates increase suddenly, demand again is pulling back. The material decline in purchase activity, combined with the rising supply of homes for sale, will cause a deceleration in price growth to more normal levels, providing some relief for buyers still interested in purchasing a home.

Information provided by Freddie Mac.

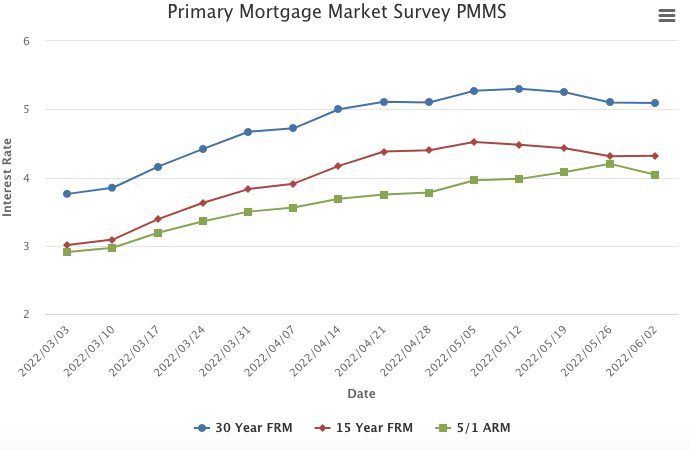

Mortgage Rates Stay Relatively Flat

June 2, 2022

Mortgage rates continued to inch downward this week but are still significantly higher than last year, affecting affordability and purchase demand. Heading into the summer, the potential homebuyer pool has shrunk, supply is on the rise and the housing market is normalizing. This is welcome news following unprecedented market tightness over the last couple years.

Information provided by Freddie Mac.

Mortgage Rates Continue to Decrease

May 26, 2022

Mortgage rates decreased for the second week in a row due to multiple headwinds that the economy is facing. Despite the recent moderation in rates, the housing market has clearly slowed, and the deceleration is spreading to other segments of the economy, such as consumer spending on durable goods.

Information provided by Freddie Mac.

April Monthly Skinny Video

- « Previous Page

- 1

- …

- 42

- 43

- 44

- 45

- 46

- …

- 62

- Next Page »