Weeklly Market Report

For Week Ending January 22, 2022

For Week Ending January 22, 2022

With a shortage of options and bidding wars reaching an all-time high last year, an increasing number of buyers waived financing, appraisal, and inspection contingencies in hopes of making their offers more attractive to sellers. That number has been trending downward in recent months, according to the National Association of REALTORS® December 2021 REALTORS® Confidence Index Survey, which reports that while 79% of buyers waived a contract contingency in June 2021, only 60% of buyers did so in December.

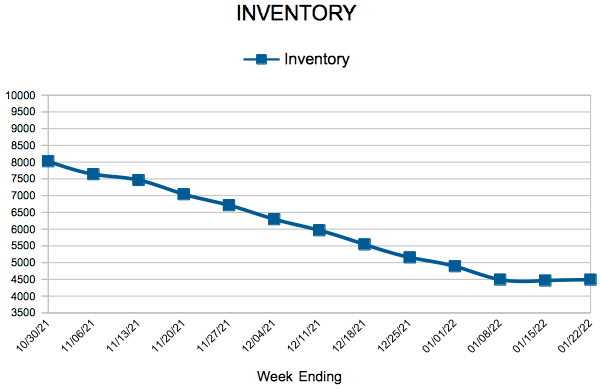

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 22:

- New Listings decreased 10.9% to 845

- Pending Sales decreased 15.6% to 767

- Inventory decreased 21.5% to 4,491

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.9% to $331,100

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 27.3% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending January 15, 2022

For Week Ending January 15, 2022

As the U.S. economy recovers from the pandemic, the number of homeowners in forbearance continues to decline, with the total number of loans in forbearance falling to 1.41% as of last measure, making it the first time in 18 months the rate has dropped below 1.5%, according to the Mortgage Bankers Association.

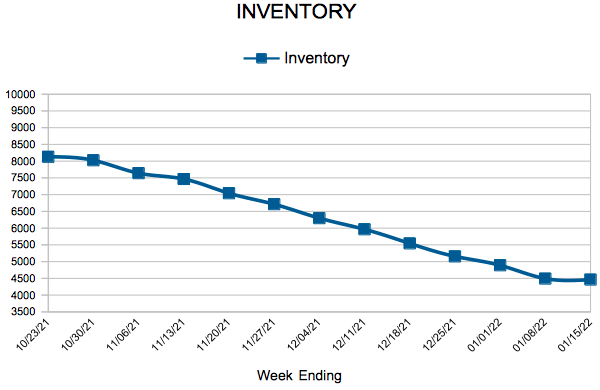

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 15:

- New Listings decreased 18.5% to 790

- Pending Sales decreased 15.0% to 722

- Inventory decreased 23.2% to 4,463

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.8% to $331,000

- Days on Market decreased 15.4% to 33

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 27.3% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending January 8, 2022

For Week Ending January 8, 2022

Mortgage rates rose to their highest level since May 2020, with the 30-year fixed rate mortgage averaging 3.22% during the first week of 2022, more than half a percent higher than January 2021. The increase in interest rates has had little effect on buyer demand, which remains high into the new year, as purchase loan applications were up 1.4% on a seasonally adjusted basis the same week, according to the Mortgage Bankers Association’s Market Composite Index.

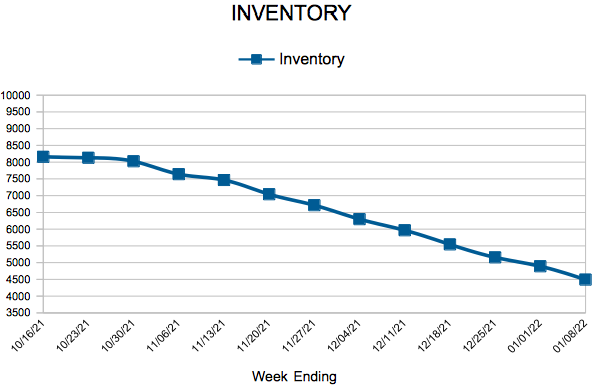

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 8:

- New Listings decreased 16.2% to 814

- Pending Sales decreased 19.1% to 541

- Inventory decreased 22.5% to 4,493

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.9% to $331,200

- Days on Market decreased 15.4% to 33

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 27.3% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 65

- 66

- 67

- 68

- 69

- …

- 79

- Next Page »