Weekly Market Report

For Week Ending April 15, 2023

For Week Ending April 15, 2023

Baby boomers—people ages 58 to 76—now make up the largest share of buyers and sellers nationwide, according to the National Association of REALTORS® 2023 Home Buyers and Sellers Generational Trends Report. Baby boomers represented 53% of sellers and 39% of buyers in transactions that occurred between July 2021 and June 2022. Millennials, once the leading share of homebuyers, came in second place, accounting for 28% of buyers according to the report.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 15:

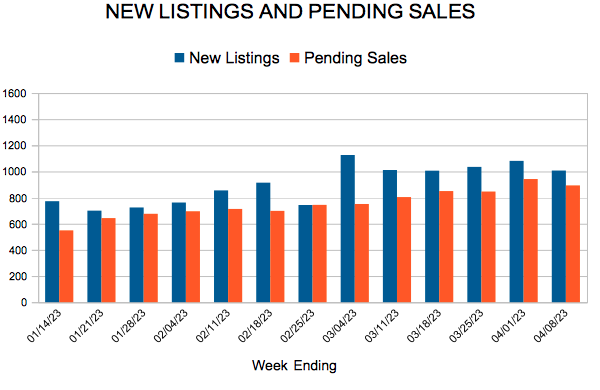

- New Listings decreased 13.4% to 1,321

- Pending Sales decreased 37.7% to 883

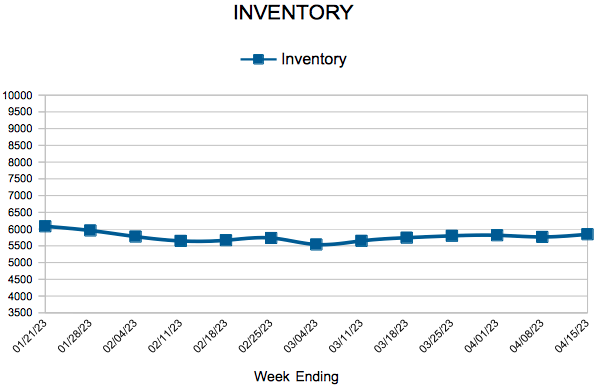

- Inventory increased 4.0% to 5,845

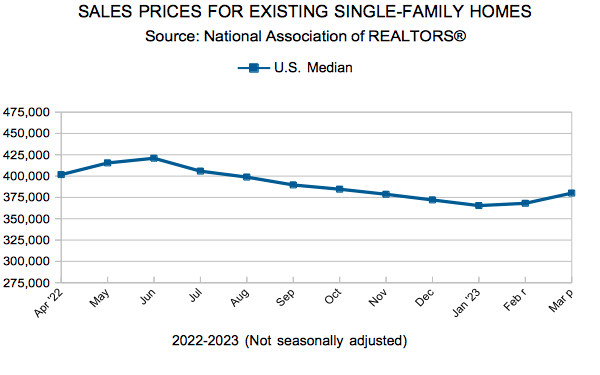

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

After Weeks of Decline, Mortgage Rates Increase

April 20, 2023

For the first time in over a month, mortgage rates moved up due to shifting market expectations. Home prices have stabilized somewhat, but with supply tight and rates stuck above six percent, affordable housing continues to be a serious issue for potential homebuyers. Unless rates drop into the mid five percent range, demand will only modestly recover.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 98

- 99

- 100

- 101

- 102

- …

- 277

- Next Page »