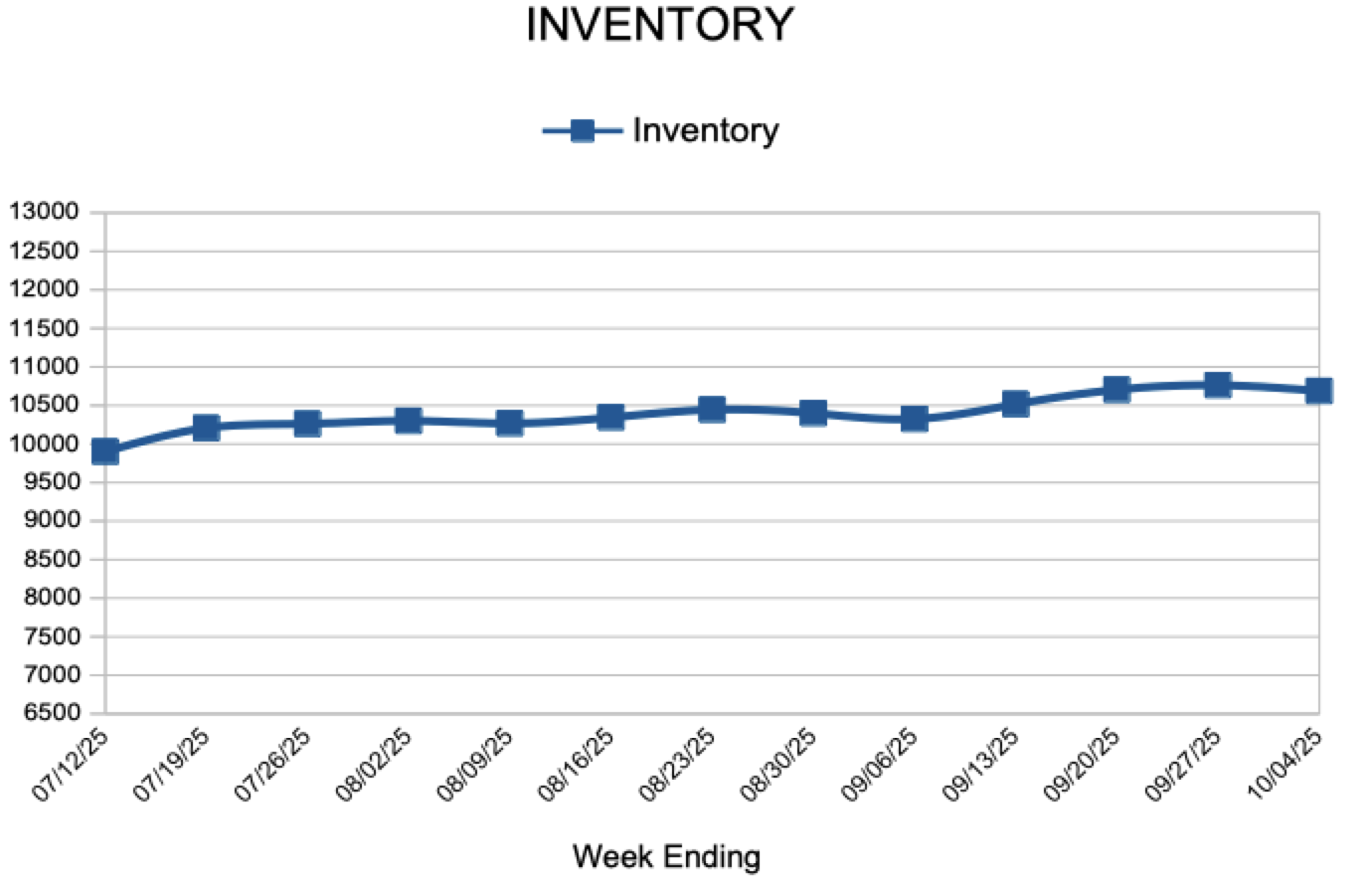

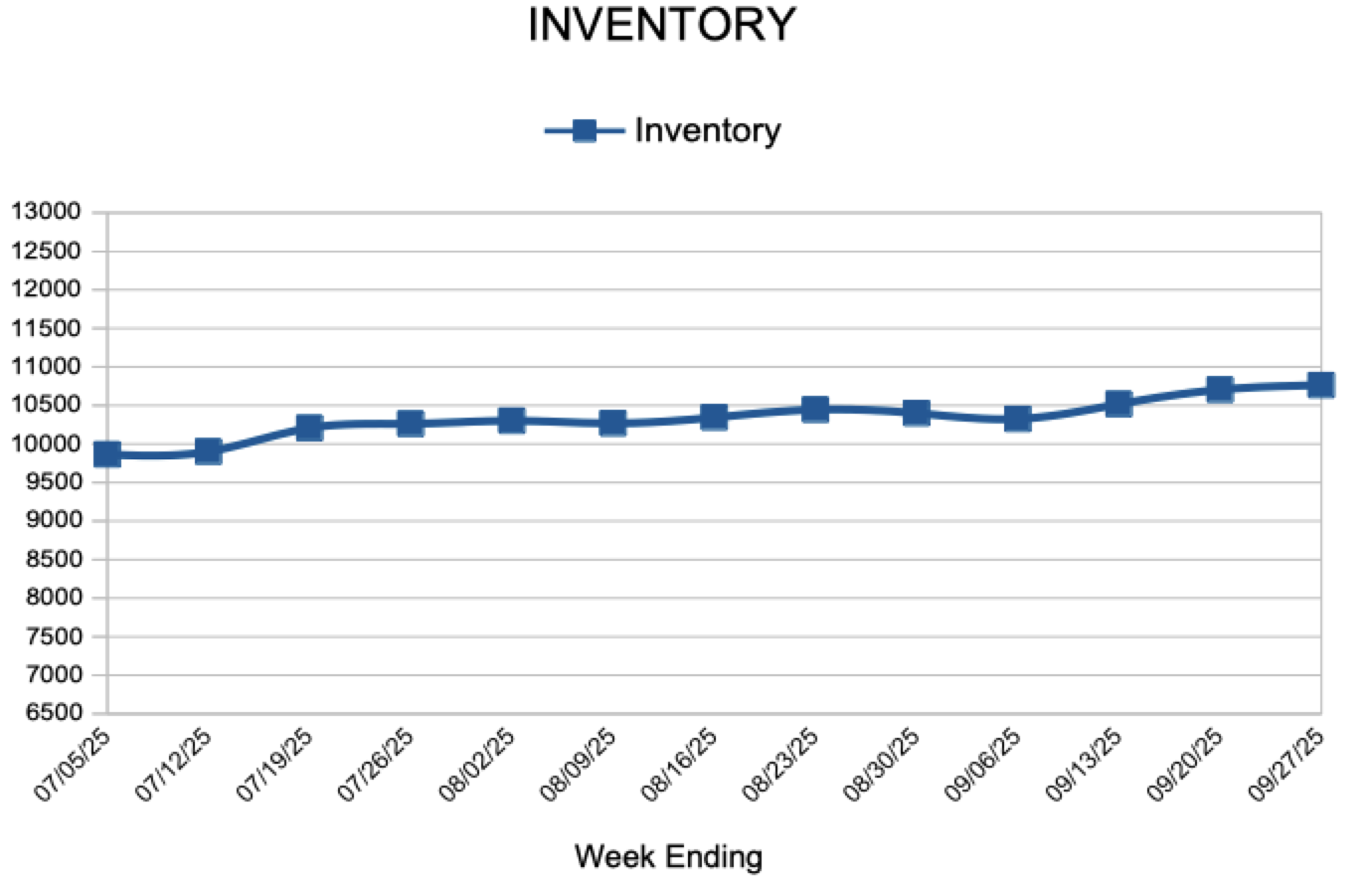

Inventory

Weekly Market Report

For Week Ending October 4, 2025

For Week Ending October 4, 2025

Nationally, the best time to buy a home is the week of October 12–18, according to a recent report from Realtor®.com. Historically, this week offers the most favorable conditions for buyers, with higher inventory levels, lower home prices, reduced competition, and a slower market pace. However, the optimal buying window varies across local markets. Some areas have already experienced peak buyer conditions, while others may not reach their ideal period until November or December.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 4:

- New Listings decreased 4.4% to 1,409

- Pending Sales decreased 5.7% to 966

- Inventory remained flat at 10,688

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.8% to $400,000

- Days on Market increased 5.0% to 42

- Percent of Original List Price Received remained flat at 98.7%

- Months Supply of Homes For Sale remained flat at 2.8

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Move Down

October 9, 2025

Mortgage rates decreased this week. Over the last few weeks, mortgage rates have settled in at their lowest level in about a year. There is growing evidence that homebuyers are digesting these lower rates and gradually are willing to move forward with buying a home, which is boosting purchase activity.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 282

- Next Page »