For Week Ending August 9, 2025

For Week Ending August 9, 2025

The average monthly mortgage payment on a median-priced home reached a record high of $2,570 in 2024, based on a 30-year fixed-rate loan and a 3.5% down payment, according to the State of the Nation’s Housing 2025 report from Harvard University’s Joint Center for Housing Studies. Using a 31% debt-to-income ratio, a homebuyer would need to earn at least $126,700 per year to afford that monthly payment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 9:

- New Listings decreased 6.9% to 1,408

- Pending Sales increased 8.5% to 1,005

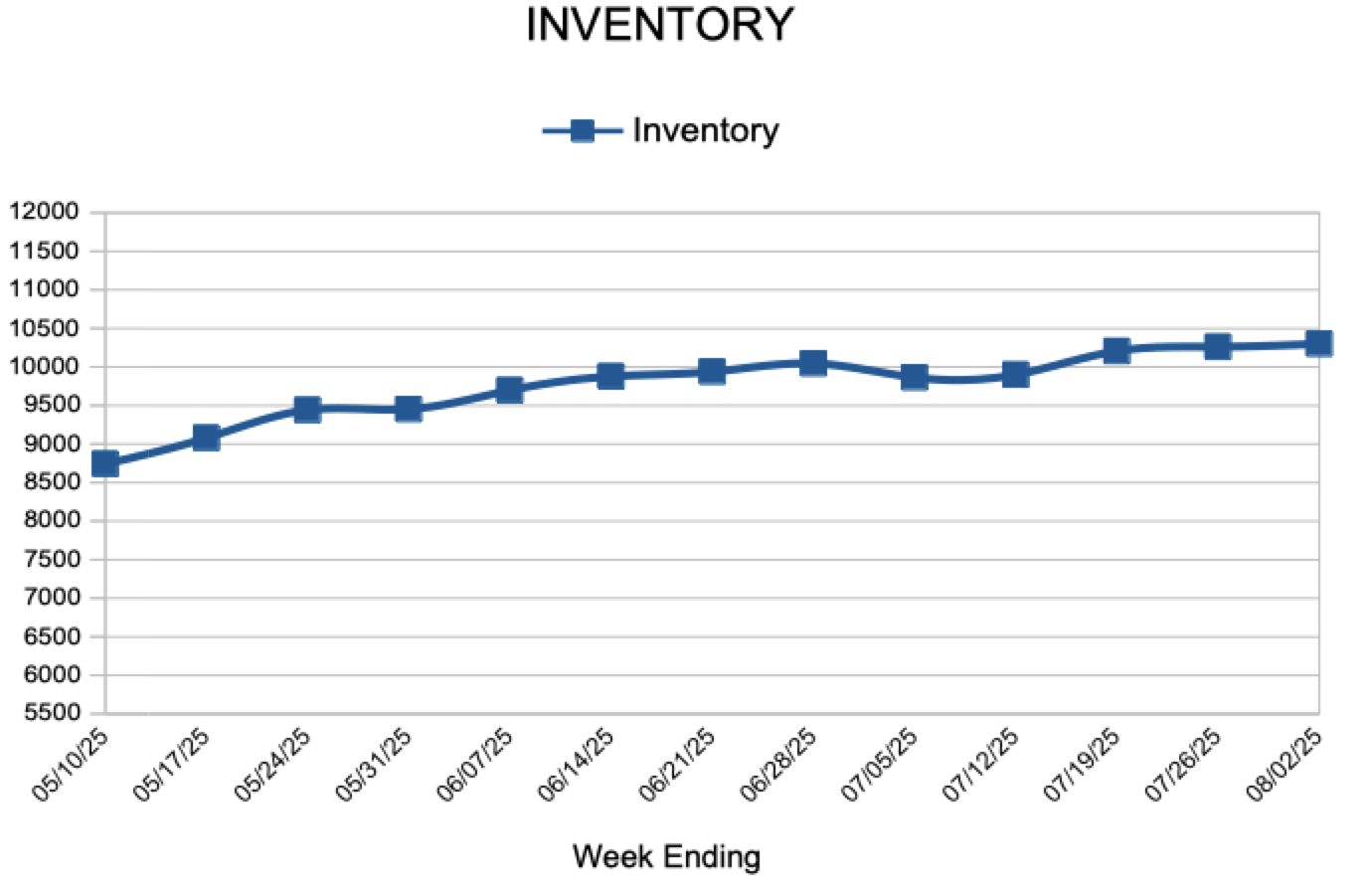

- Inventory increased 2.2% to 10,268

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.6% to $395,000

- Days on Market increased 11.1% to 40

- Percent of Original List Price Received decreased 0.2% to 99.3%

- Months Supply of Homes For Sale remained flat at 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.