Weekly Market Report

For Week Ending October 30, 2021

For Week Ending October 30, 2021

Millennials are leading the housing boom, accounting for 37% of home purchase over the last year, according to Barron’s. Increasing net worth, household formation, low mortgage rates, and a robust economy are a few of the reasons behind the recent growth of homebuyers in this age segment. With Millennials representing 22% of the U.S. population–and with their peak earning years ahead—experts remain optimistic about this generation’s impact on the housing market.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 30:

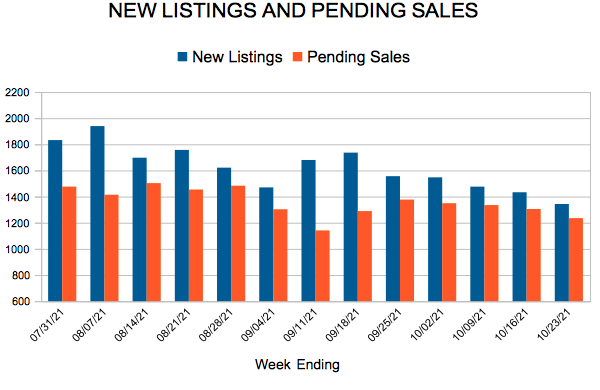

- New Listings increased 3.7% to 1,309

- Pending Sales increased 1.2% to 1,345

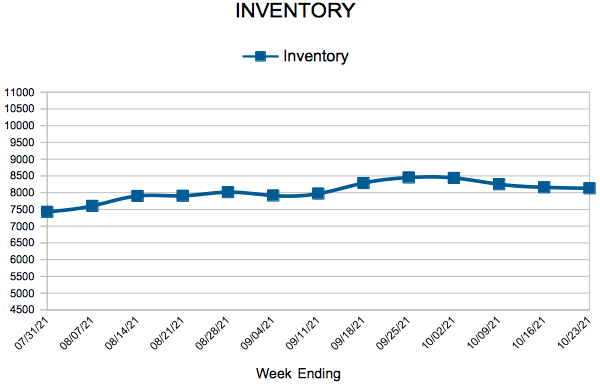

- Inventory decreased 13.8% to 8,025

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 9.9% to $340,700

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 15.8% to 1.6

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 23, 2021

For Week Ending October 23, 2021

Mortgage rates are on the rise, with the 30-year fixed-rate mortgage averaging 3.09% for the week ending October 21, 2021, according to Freddie Mac. Rates have climbed nearly one-third of a percent since early August. Despite increasing rates, which are projected to remain above 3% for the fourth quarter and rise even further next year, economists are expecting the housing market to continue to be active into 2022, thanks in part to strong buyer demand and increases in new listings.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 23:

- New Listings decreased 5.3% to 1,343

- Pending Sales decreased 14.7% to 1,235

- Inventory decreased 15.8% to 8,130

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 10.0% to $340,850

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 21.1% to 1.5

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 153

- 154

- 155

- 156

- 157

- …

- 214

- Next Page »