According to CoreLogic’s latest Home Price Insights Report, national home prices in August were up 5.5% from August 2017. This marks the first time since June 2016 that home prices did not appreciate by at least 6.0% year-over-year.

CoreLogic’s Chief Economist Frank Nothaft gave some insight into this change,

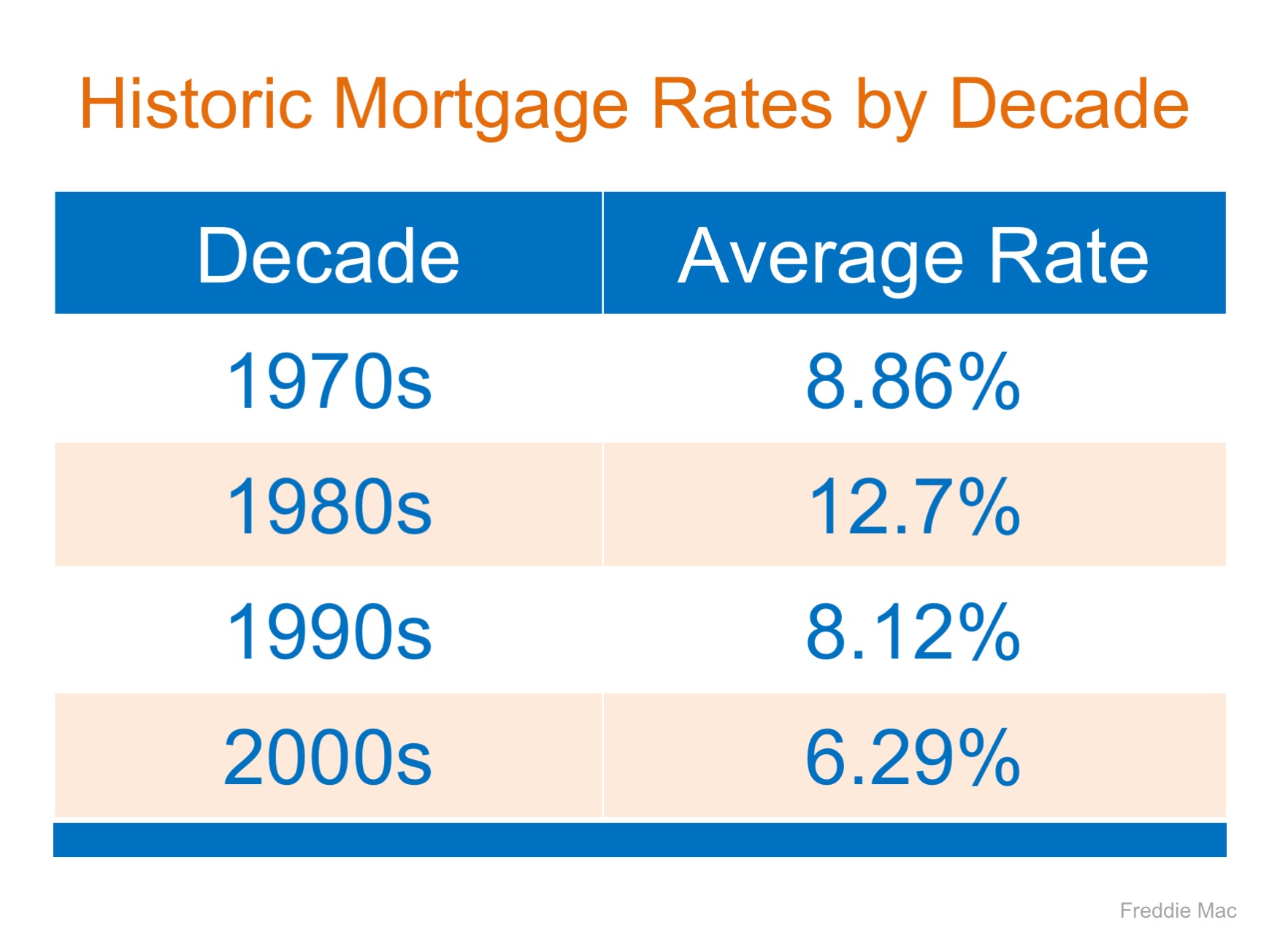

“The rise in mortgage rates this summer to their highest level in seven years has made it more difficult for potential buyers to afford a home. The slackening in demand is reflected in the slowing of national appreciation, as illustrated in the CoreLogic Home Price Index.

National appreciation in August was the slowest in nearly two years, and we expect appreciation to slow further in the coming year.”

One of the major factors that has driven prices to accelerate at a pace of between 6-7% over the past two years was the lack of inventory available for sale in many areas of the country. This made houses a prized commodity which forced many buyers into bidding wars and drove prices even higher.

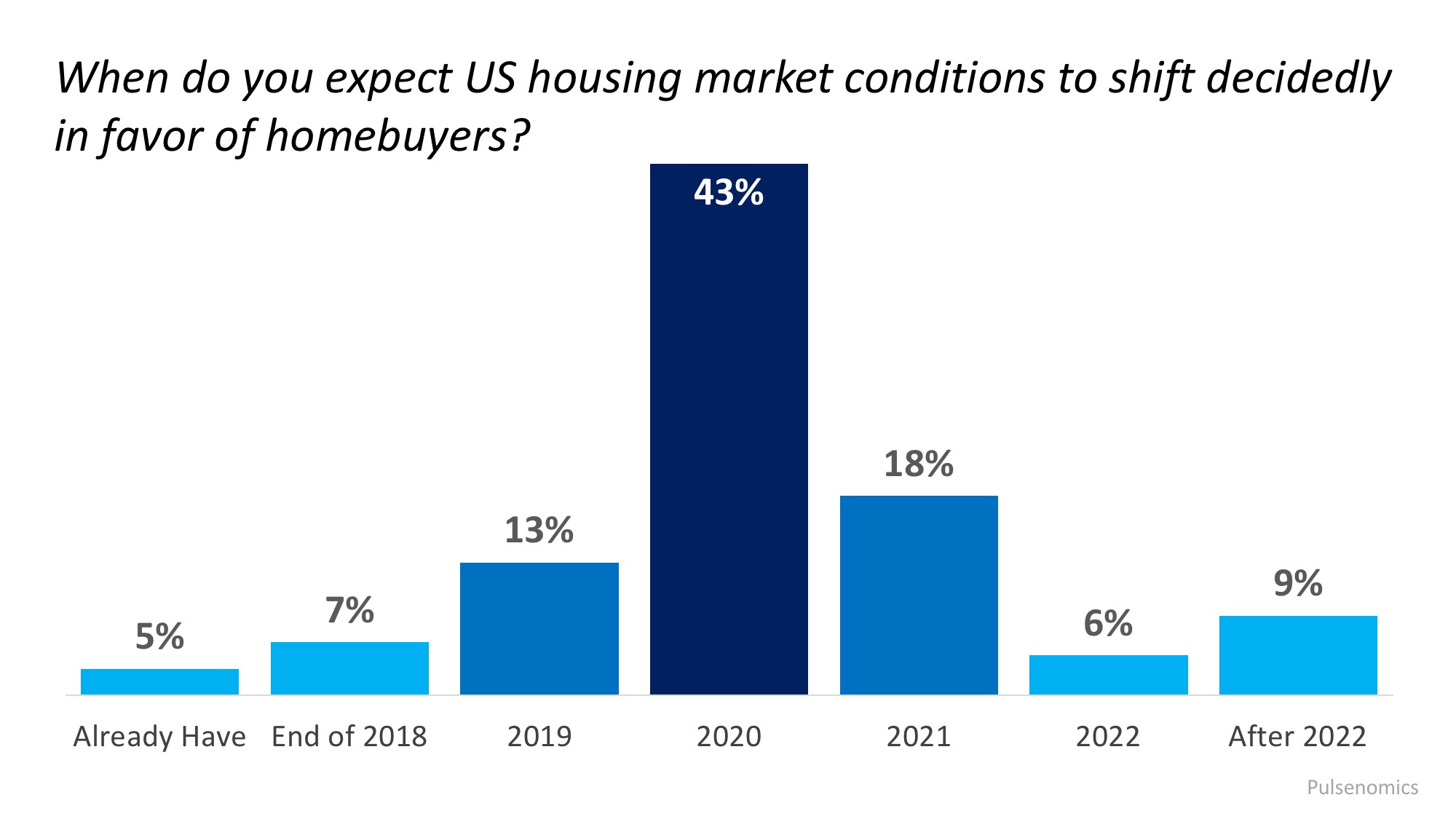

According to the National Association of Realtors’ (NAR) latest Existing Home Sales Report, we are starting to see more inventory come to market over the last few months. This, paired with patient buyers who are willing to wait to find the right homes, is creating a natural environment for price growth to slow.

Historically, prices appreciated at a rate of 3.7% (from 1987-1999). CoreLogic predicts that prices will continue to rise over the next year at a rate of 4.7%.

Bottom Line

As the housing market moves closer to a ‘normal market’ with more inventory for buyers to choose from, home prices will start to appreciate at a more ‘normal’ level, and that’s ok! If you are curious about home prices in your area, let’s get together to chat about what’s going on!

![Buying a Home is Cheaper than Renting in 38 States! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/10/04152645/20181005-Share-STM.jpg)

![Buying a Home is Cheaper than Renting in 38 States! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/10/04152637/20181005-STM-ENG.jpg)