![Buying a Home is Cheaper than Renting in 38 States! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/10/04152645/20181005-Share-STM.jpg)

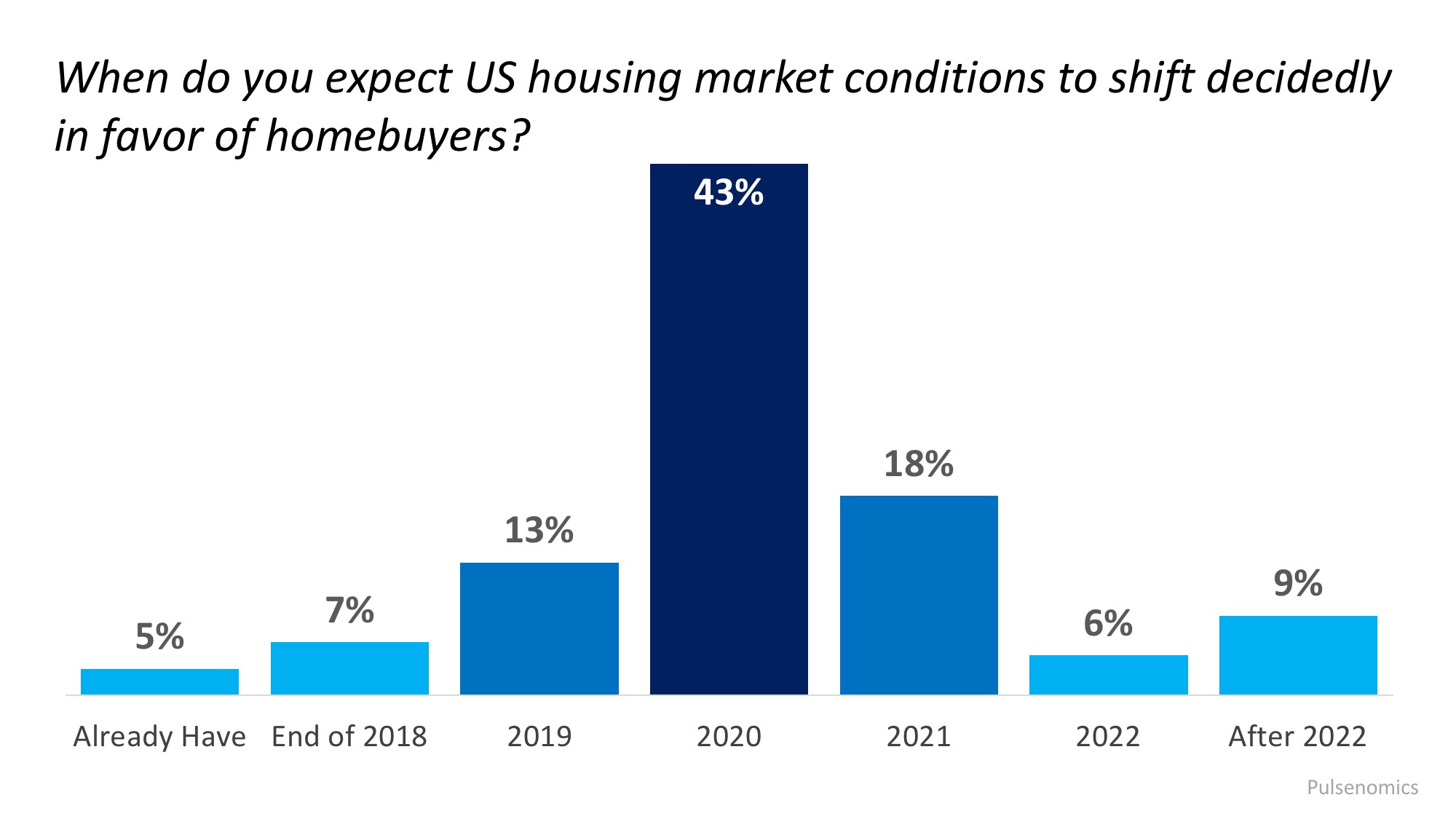

Some Highlights:

- According to a study by GOBankingRates, it is cheaper to buy a home than rent in 38 states across the country.

- In six states the difference between buying & renting would account for less than a $50 monthly difference, leaving the choice up to the individual family.

- Nationwide, it is now 26.3% cheaper to buy.

![Buying a Home is Cheaper than Renting in 38 States! [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/10/04152637/20181005-STM-ENG.jpg)

![Should I Buy Now? Or Wait Until Next Year? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2018/09/27122924/20180928-STM-ENG.jpg)