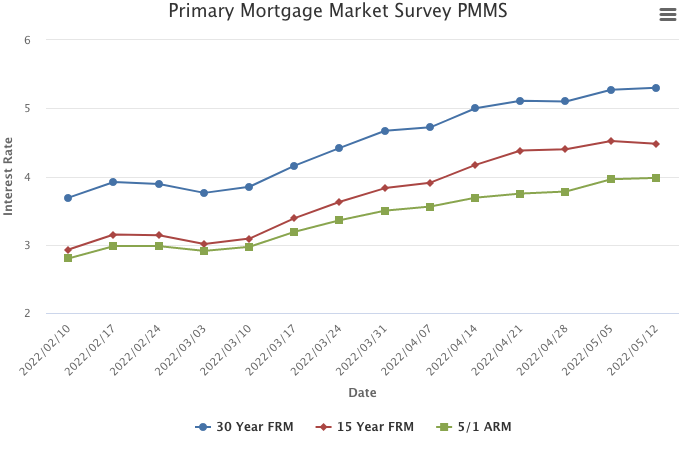

May 26, 2022

Mortgage rates decreased for the second week in a row due to multiple headwinds that the economy is facing. Despite the recent moderation in rates, the housing market has clearly slowed, and the deceleration is spreading to other segments of the economy, such as consumer spending on durable goods.

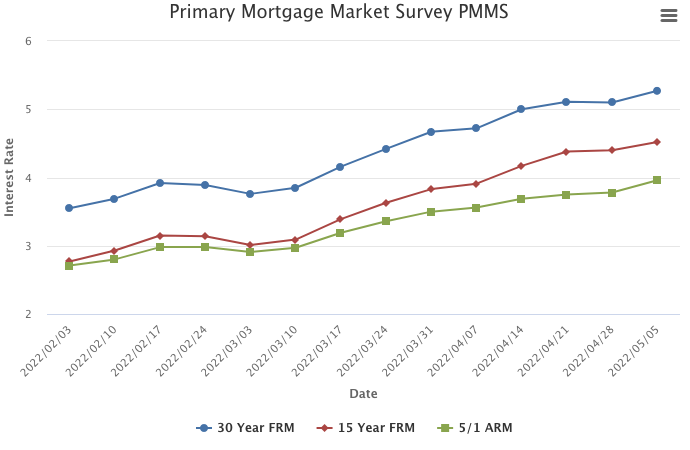

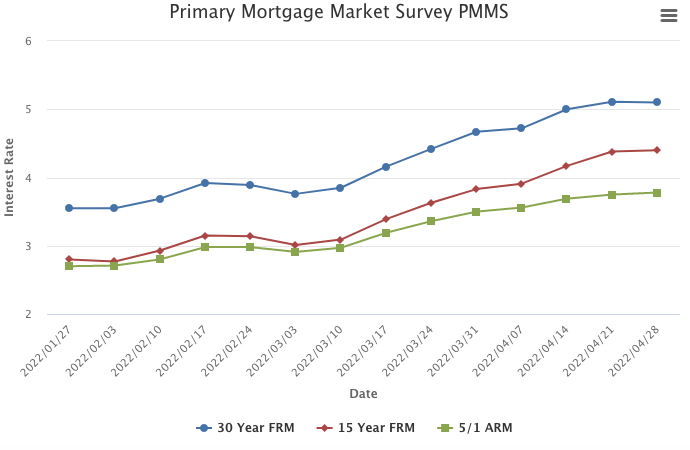

Information provided by Freddie Mac.