The U.S. real estate market remains hot ahead of the spring selling season, with existing home sales up 6.7% as of last measure. Experts attribute the growth in sales to an uptick in mortgage interest rates, as buyers rushed to lock down their home purchases before rates move higher. Even so, sales prices continue to rise with a Median Sales Price increase of 8.3 percent to $340,000 from this time last year.

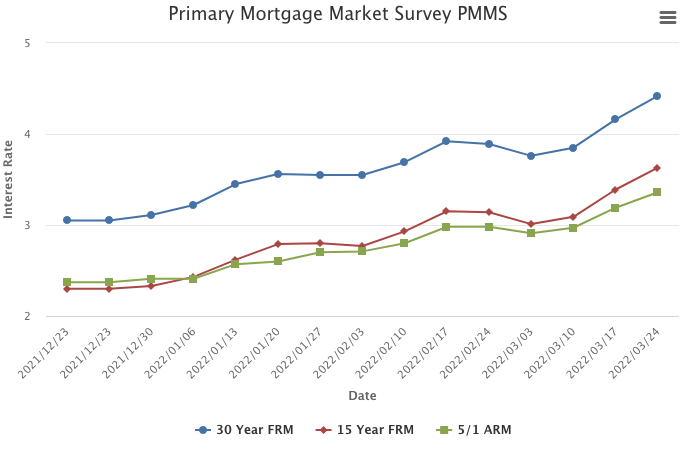

Mortgage Rates Continue to Move Up

March 24, 2022

This week, the 30-year fixed-rate mortgage increased by more than a quarter of a percent as mortgage rates across all loan types continued to move up. Rising inflation, escalating geopolitical uncertainty and the Federal Reserve’s actions are driving rates higher and weakening consumers’ purchasing power. In short, the rise in mortgage rates, combined with continued house price appreciation, is increasing monthly mortgage payments and quickly affecting homebuyers’ ability to keep up with the market.

Information provided by Freddie Mac.

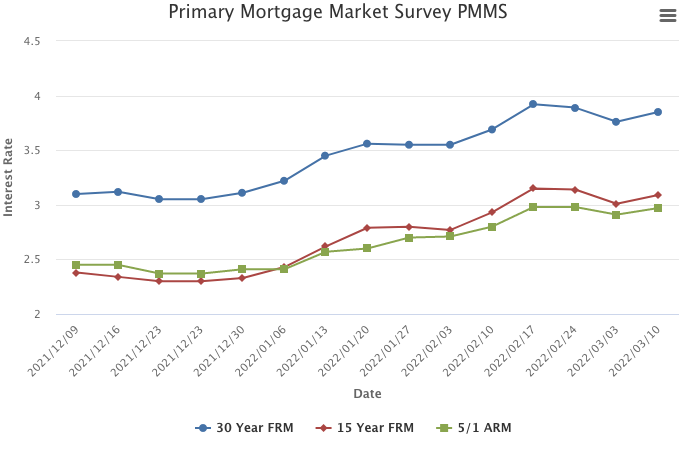

Mortgage Rates Exceed Four Percent

March 17, 2022

The 30-year fixed-rate mortgage exceeded four percent for the first time since May of 2019. The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year. While home purchase demand has moderated, it remains competitive due to low existing inventory, suggesting high house price pressures will continue during the spring homebuying season.

Information provided by Freddie Mac.

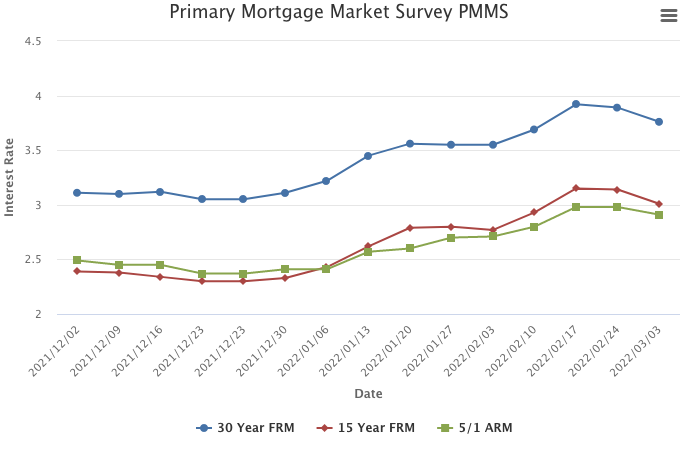

Mortgage Rates Rise

March 10, 2022

Following two weeks of declines, mortgage rates rose this week as U.S. Treasury yields increased. Over the long-term, we expect rates to continue to rise as inflation broadens and shortages increasingly impact many segments of the economy. However, uncertainty about the war in Ukraine is driving rate volatility that likely will continue in the short-term.

Information provided by Freddie Mac.

Mortgage Rates Fall

March 3, 2022

Geopolitical tensions caused U.S. Treasury yields to recede this week as investors moved to the safety of bonds, leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.

Information provided by Freddie Mac.

Mortgage Rates Decrease Slightly

February 24, 2022

Even with this week’s decline, mortgage rates have increased more than a full percent over the last six months. Overall economic growth remains strong, but rising inflation is already impacting consumer sentiment, which has markedly declined in recent months. As we enter the spring homebuying season with higher mortgage rates and continued low inventory, we expect home price growth to remain firm before cooling off later this year.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 32

- 33

- 34

- 35

- 36

- …

- 49

- Next Page »