Weekly Market Report

For Week Ending November 16, 2024

For Week Ending November 16, 2024

The number of homes available for sale hit its highest level since December 2019, rising 29.2% year-over-year in October, the 12th consecutive month of growth, according to Realtor.com. Homes spent an average of 58 days on market, three more days than the previous month and eight more days than the same time last year, giving buyers more time and more options in their home search.

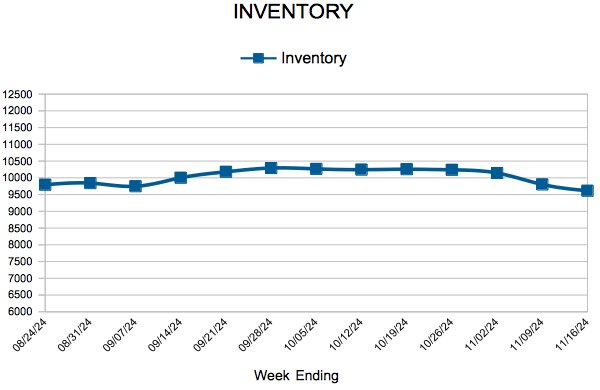

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 16:

- New Listings increased 5.1% to 1,002

- Pending Sales increased 7.0% to 777

- Inventory increased 6.4% to 9,614

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.1% to $380,000

- Days on Market increased 21.6% to 45

- Percent of Original List Price Received decreased 0.7% to 97.8%

- Months Supply of Homes For Sale increased 8.0% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 9, 2024

For Week Ending November 9, 2024

U.S. pending home sales increased 7.4% month-over-month and 2.6% year-over-year, as falling mortgage rates in August and September helped under contract sales rise to their highest level since March, according to the National Association of REALTORS®. Pending sales were up in all four regions of the country, with the West posting the highest monthly gain at 9.8%.

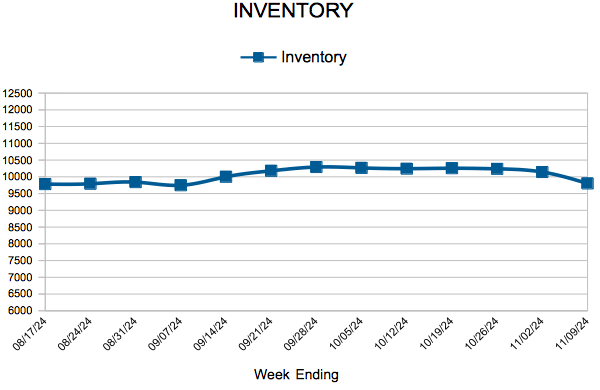

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 9:

- New Listings increased 1.2% to 1,004

- Pending Sales increased 15.0% to 721

- Inventory increased 7.1% to 9,802

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.1% to $380,000

- Days on Market increased 21.6% to 45

- Percent of Original List Price Received decreased 0.7% to 97.8%

- Months Supply of Homes For Sale increased 8.0% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 2, 2024

For Week Ending November 2, 2024

U.S. housing starts edged down 0.5% from the previous month to a seasonally adjusted annual rate of 1.35 million units, according to the U.S. Census Bureau. Single-family housing starts rose 2.7% to a seasonally adjusted annual rate of 1.03 million units, a five-month high, while multi-family housing starts declined 4.5% to 317,000 units. Year to date, single-family construction is up 10.1%.

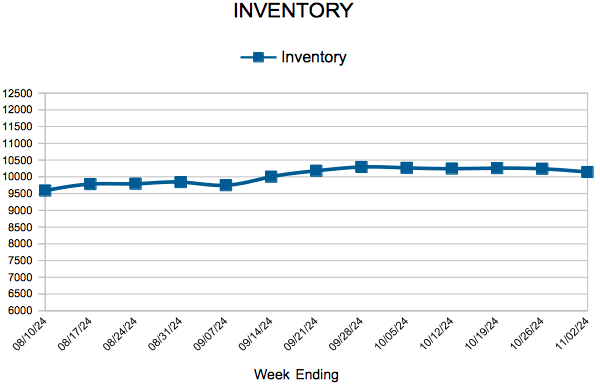

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 2:

- New Listings decreased 3.1% to 1,035

- Pending Sales increased 7.8% to 839

- Inventory increased 9.7% to 10,144

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $379,950

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 16

- 17

- 18

- 19

- 20

- …

- 77

- Next Page »