Weekly Market Report

For Week Ending October 26, 2024

For Week Ending October 26, 2024

Millennials—people ages 28 to 43—make up the largest share of homebuyers nationwide, according to the National Association of REALTORS® 2024 Home Buyers and Sellers Generational Trends Report. Millennials comprised 38% of buyers in transactions that occurred between July 2022 and June 2023, up from 28% the previous 12-month period. Meanwhile, baby boomers, who held the top spot among homebuyers last year at 39%, came in second place, accounting for 31% of all purchase transactions.

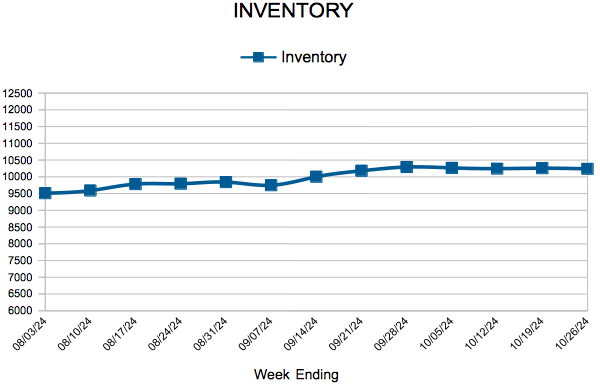

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 26:

- New Listings increased 10.2% to 1,112

- Pending Sales increased 20.0% to 840

- Inventory increased 9.9% to 10,239

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $380,000

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 19, 2024

For Week Ending October 19, 2024

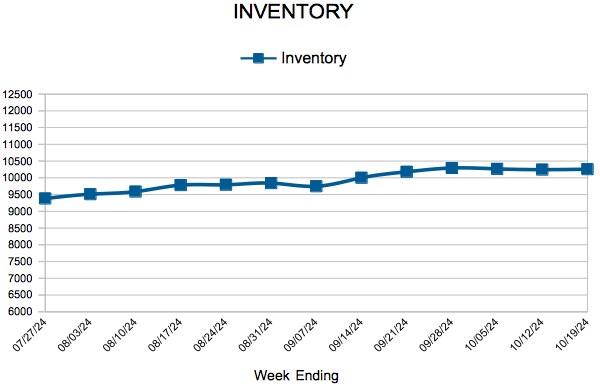

The number of homes for sale continues to grow nationwide, with Realtor.com reporting there were 34% more homes actively for sale in September compared to the same time last year. This marks the 11th consecutive month of annual growth, with supply now at the highest level since April 2020. Despite the upward trend, however, inventory is 23.2% lower compared to typical 2017 – 2019 levels.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 19:

- New Listings increased 2.4% to 1,215

- Pending Sales increased 11.5% to 862

- Inventory increased 10.6% to 10,257

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $380,000

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 12, 2024

For Week Ending October 12, 2024

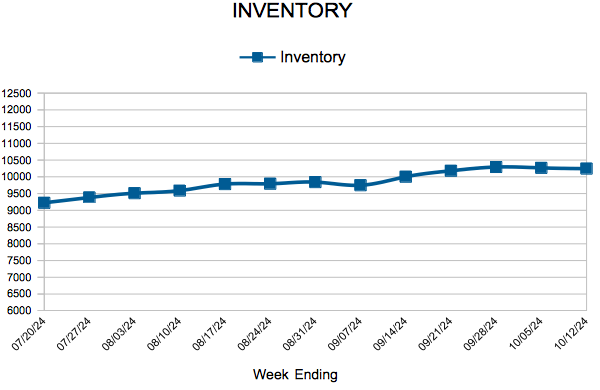

According to the Mortgage Bankers Association, the median mortgage application payment was $2,057 in August, down from $2,140 in July, marking the fourth consecutive month affordability conditions improved. Mortgage rates are down significantly from their peak of 7.79% last October, which should help bring additional buyers to the market in the months ahead.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 12:

- New Listings increased 12.5% to 1,368

- Pending Sales increased 7.3% to 865

- Inventory increased 10.8% to 10,244

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $379,950

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 17

- 18

- 19

- 20

- 21

- …

- 77

- Next Page »