For Week Ending June 1, 2024

For Week Ending June 1, 2024

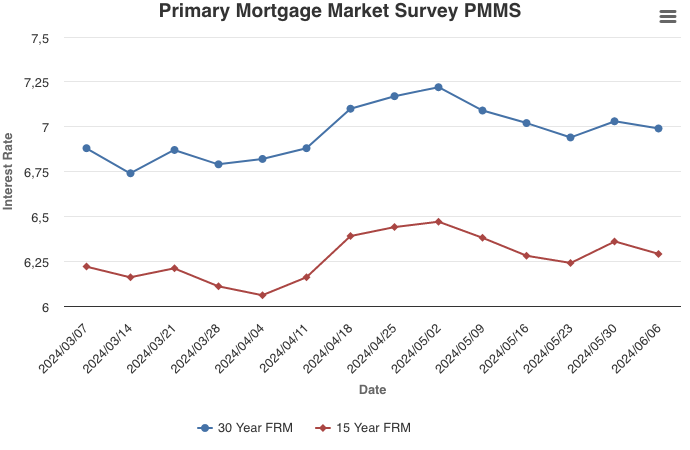

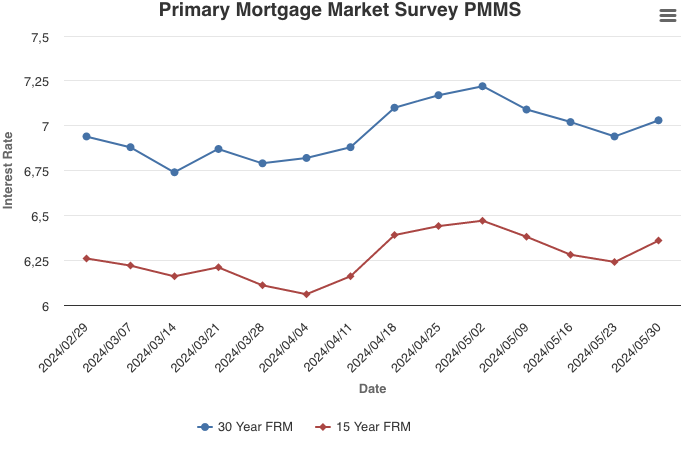

The average American household spent 24.2% of their income on mortgage payments in the first three months of the year, according to the National Association of REALTORS®, down from 26.1% the previous quarter. Assuming a 20% down payment, the typical monthly mortgage payment on an existing single-family home was $2,037 in the first quarter, an increase of 9.3%, or $173 per month, compared to the same period a year ago.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 1:

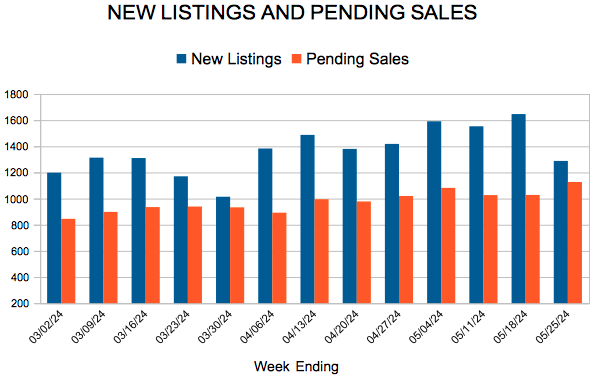

- New Listings decreased 3.8% to 1,463

- Pending Sales decreased 5.0% to 960

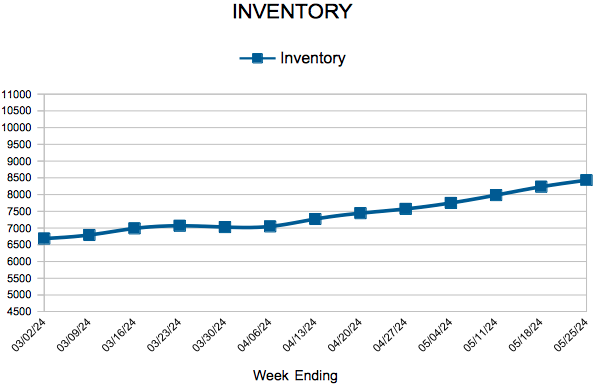

- Inventory increased 14.0% to 8,450

FOR THE MONTH OF APRIL:

- Median Sales Price increased 4.1% to $385,000

- Days on Market remained flat at 46

- Percent of Original List Price Received decreased 0.2% to 99.9%

- Months Supply of Homes For Sale increased 23.5% to 2.1

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.