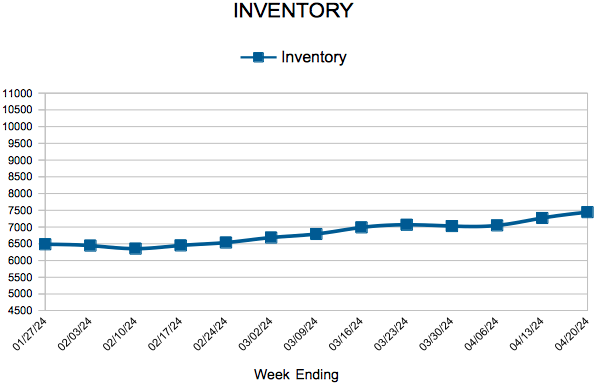

Inventory

Weekly Market Report

For Week Ending April 20, 2024

For Week Ending April 20, 2024

U.S. residential housing starts unexpectedly declined as of last measure, falling 14.7% from the previous month to a seasonally adjusted annual rate of 1.32 million units, according to the U.S. Census Bureau. Building permits and housing completions were also down month-over-month, sliding 4.3% and 13.5%, respectively, as higher interest rates and rising construction and development costs continue to impact homebuilders.

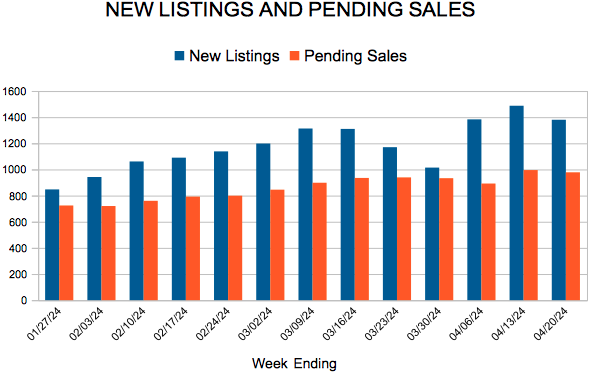

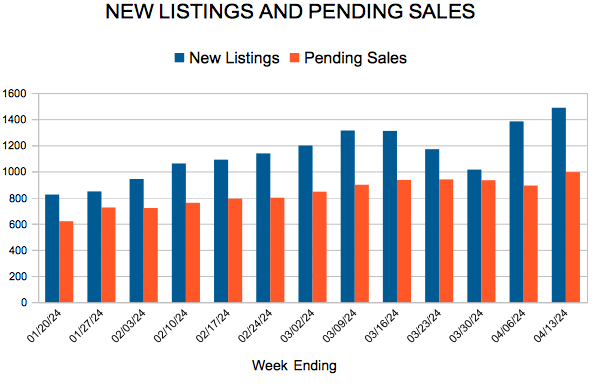

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 20:

- New Listings increased 0.6% to 1,380

- Pending Sales increased 2.1% to 978

- Inventory increased 14.8% to 7,444

FOR THE MONTH OF MARCH:

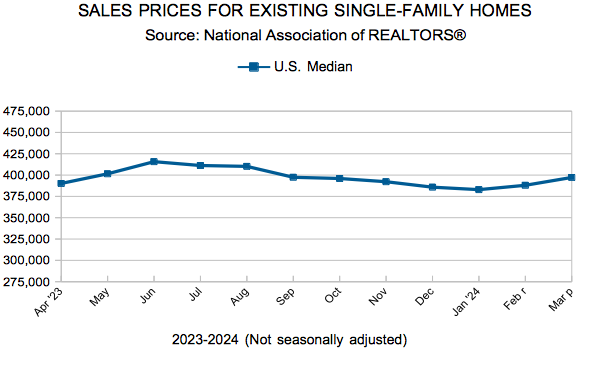

- Median Sales Price increased 2.8% to $366,000

- Days on Market decreased 6.9% to 54

- Percent of Original List Price Received increased 0.2% to 98.8%

- Months Supply of Homes For Sale increased 26.7% to 1.9

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

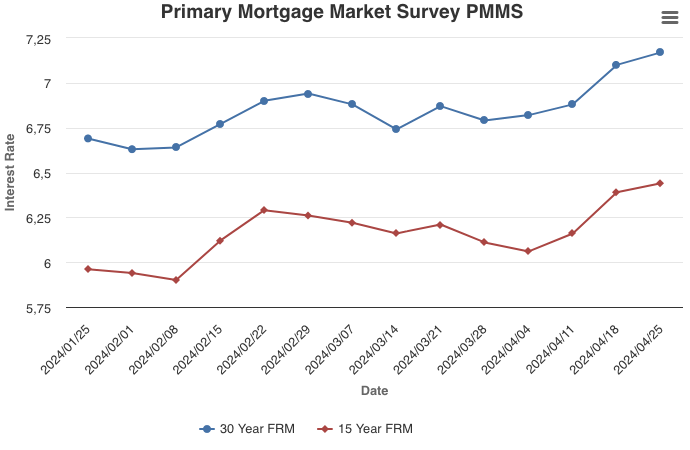

Mortgage Rates Continue to Increase

April 25, 2024

Mortgage rates continued rising this week. Despite rates increasing more than half a percent since the first week of the year, purchase demand remains steady. With rates staying higher for longer, many homebuyers are adjusting, as evidenced by this week’s report that sales of newly built homes saw the biggest increase since December 2022.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 60

- 61

- 62

- 63

- 64

- …

- 280

- Next Page »