Weekly Market Report

For Week Ending December 27, 2025

For Week Ending December 27, 2025

Nationally, 46.1% of mortgaged residential properties were classified as equity-rich in the third quarter of 2025, according to ATTOM’s latest 2025 U.S. Home Equity & Underwater Report. This marks a slight decline from 47.4% the previous quarter and from 48.3% the same time last year. The three states with the highest share of equity-rich properties were Vermont (86.8%), New Hampshire (61.4%), and Rhode Island (59.8%).

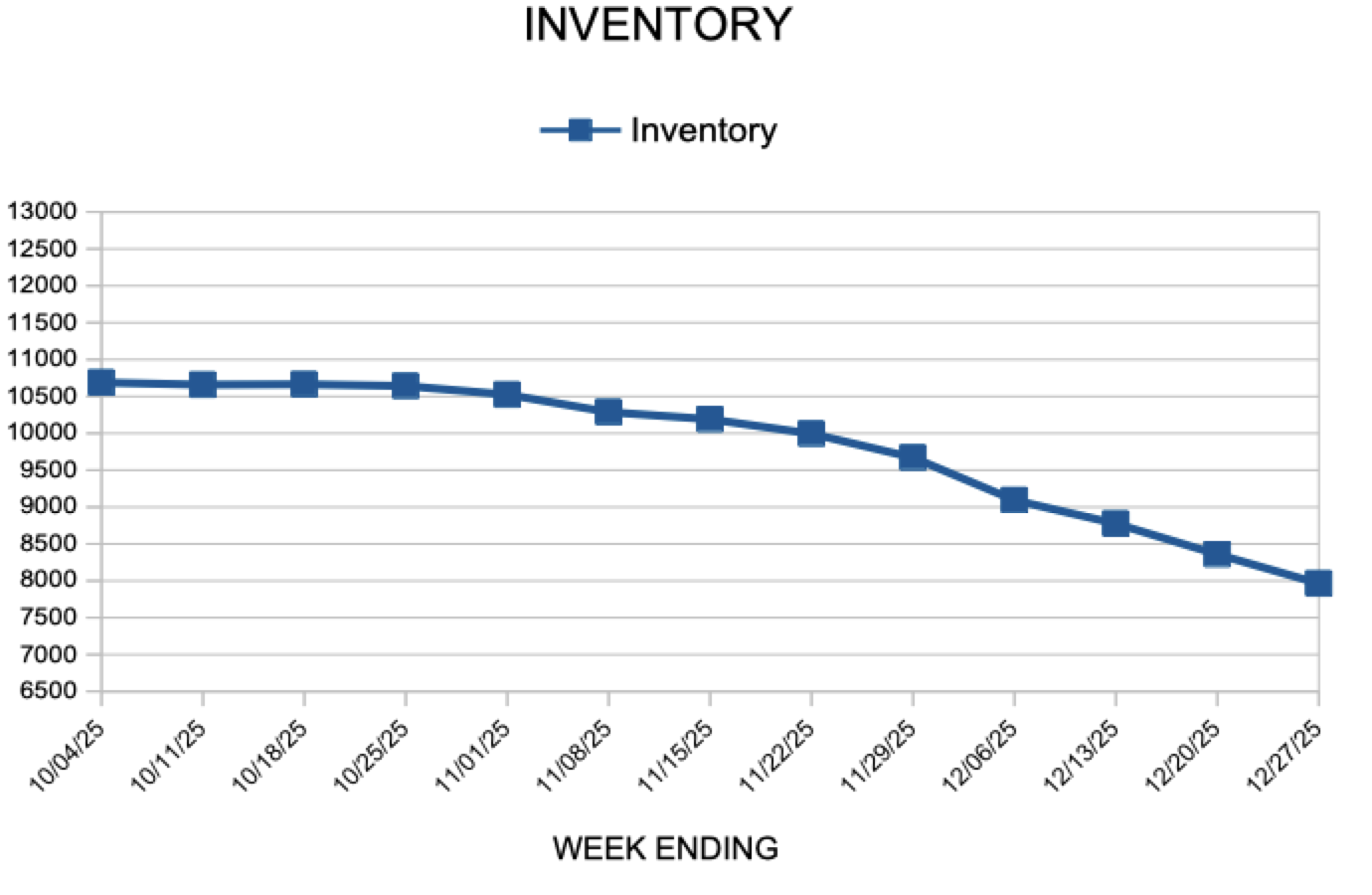

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 27:

- New Listings decreased 22.4% to 267

- Pending Sales decreased 11.9% to 376

- Inventory decreased 2.9% to 7,964

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.9% to $387,000

- Days on Market remained flat at 50

- Percent of Original List Price Received decreased 0.2% to 97.4%

- Months Supply of Homes For Sale remained flat at 2.

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Decrease

November 26, 2025

Heading into the Thanksgiving holiday, mortgage rates decreased. With pending home sales at the highest level since last November, homebuyer activity continues to show resilience nearing year end.

- The 30-year fixed-rate mortgage averaged 6.23% as of November 26, 2025, down from last week when it averaged 6.26%. A year ago at this time, the 30-year FRM averaged 6.81%.

- The 15-year fixed-rate mortgage averaged 5.51%, down from last week when it averaged 5.54%. A year ago at this time, the 15-year FRM averaged 6.10%.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 15, 2025

For Week Ending November 15, 2025

The U.S. housing supply gap reached 3.8 million units in 2024, according to an analysis by Realtor®.com. For the first time since 2016, new construction outpaced household formations, with more than 1.6 million units completed last year, the highest level in nearly two decades. While builders are making progress, it would still take about 7.5 years to close the housing gap at the 2024 pace of construction.

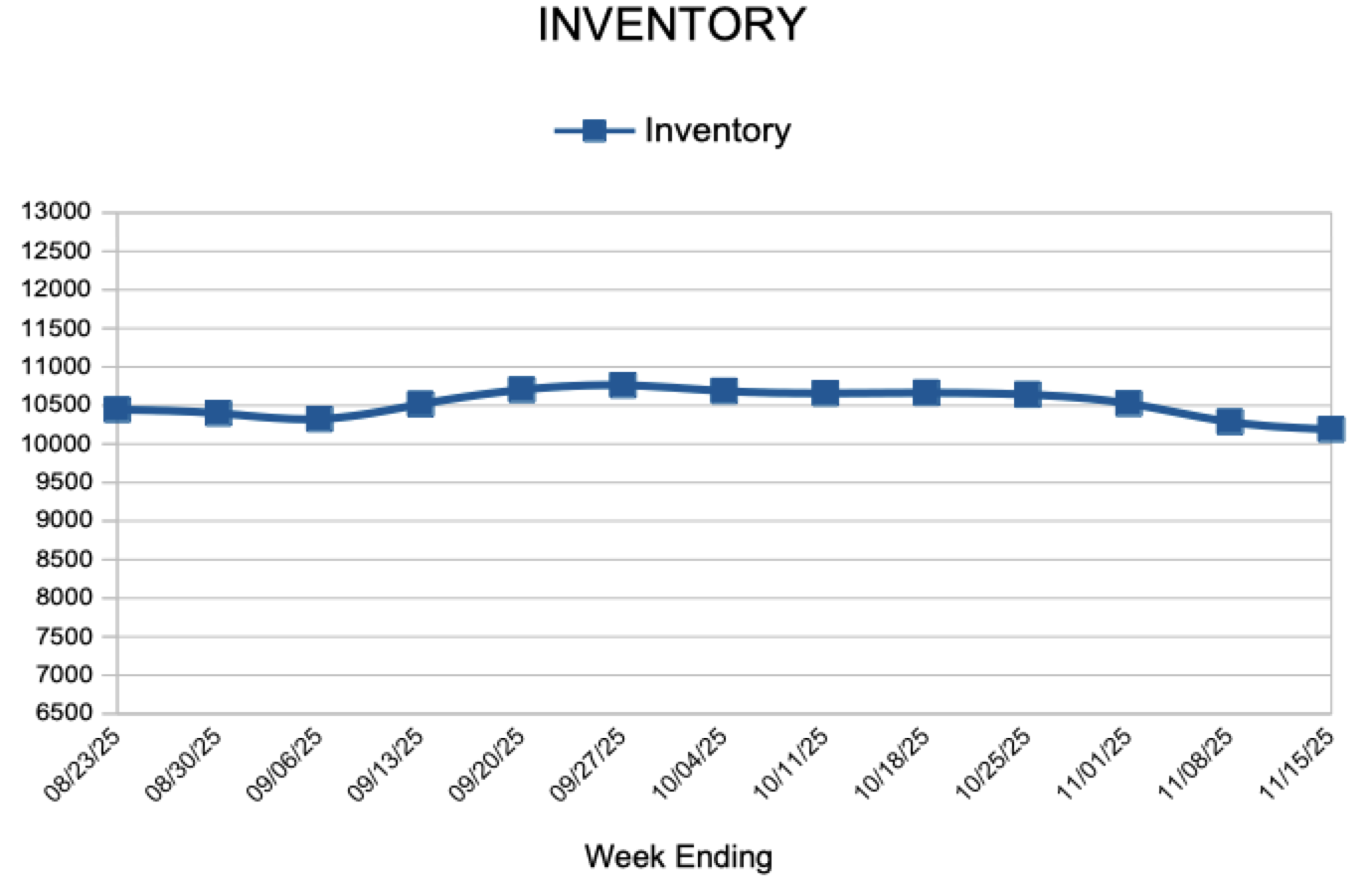

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 15:

- New Listings increased 0.7% to 1,022

- Pending Sales decreased 1.8% to 774

- Inventory increased 0.8% to 10,190

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- 9

- …

- 283

- Next Page »