Weekly Market Report

For Week Ending December 23, 2023

For Week Ending December 23, 2023

The median household income for U.S. homebuyers hit a record high of $107,000 recently, a 21.6% increase from a year ago, according to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers. Despite higher home prices and rising borrowing costs, the share of first-time buyers also grew, increasing from 26% in 2022 to 32% this year. Down payments continued to climb as well, with the typical down payment for first-time buyers averaging 8%, the highest share since 1997, according to the report.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 23:

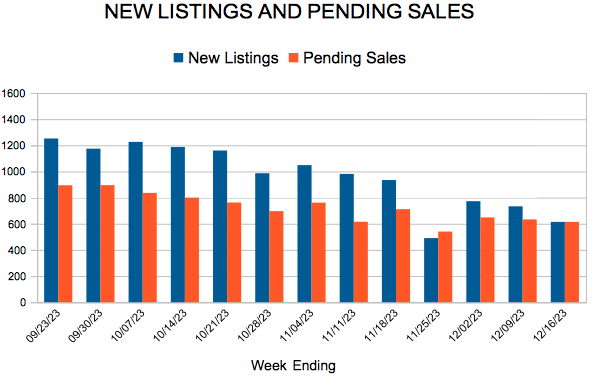

- New Listings increased 37.3% to 453

- Pending Sales increased 20.7% to 571

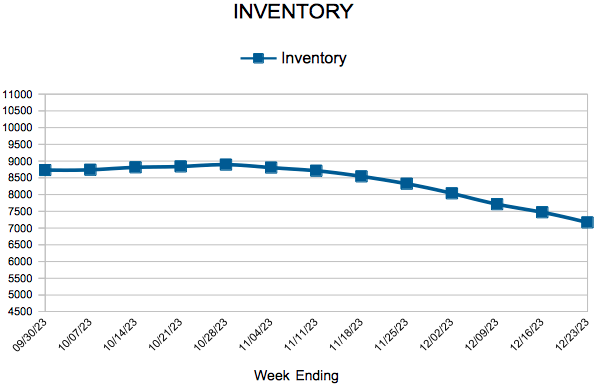

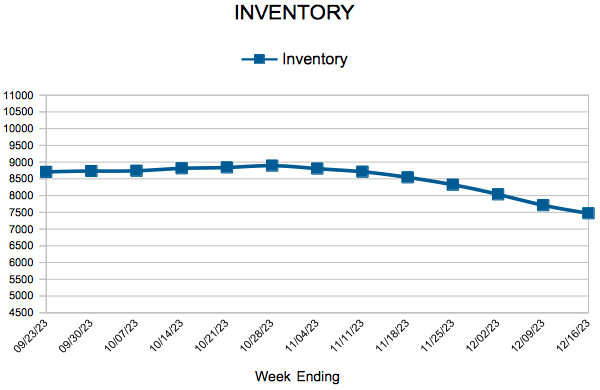

- Inventory decreased 4.3% to 7,167

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,600

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

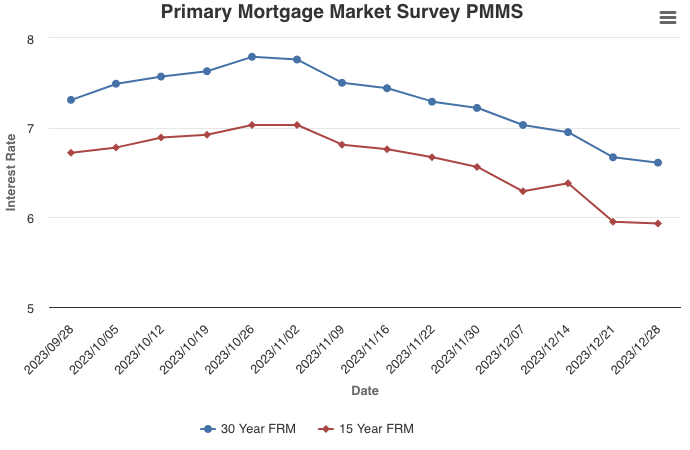

Heading into the New Year, Mortgage Rates Remain on a Downward Trend

December 28, 2023

The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down. Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 16, 2023

For Week Ending December 16, 2023

47.4% of mortgaged residential properties were considered equity-rich—having at least 50% equity in one’s home—in the third quarter of 2023, according to ATTOM’s Q3 2023 U.S. Home Equity and Underwater Report. This marks a decline from the second quarter, when 49.2% of mortgaged homes were considered equity rich. However, the portion of homes that were seriously underwater recently improved, increasing from one in 36 homes in the second quarter of 2023 to one in 40 homes in the third quarter, the lowest point in more than four years.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 16:

- New Listings increased 11.0% to 614

- Pending Sales decreased 1.4% to 614

- Inventory decreased 5.0% to 7,470

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,600

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 75

- 76

- 77

- 78

- 79

- …

- 282

- Next Page »