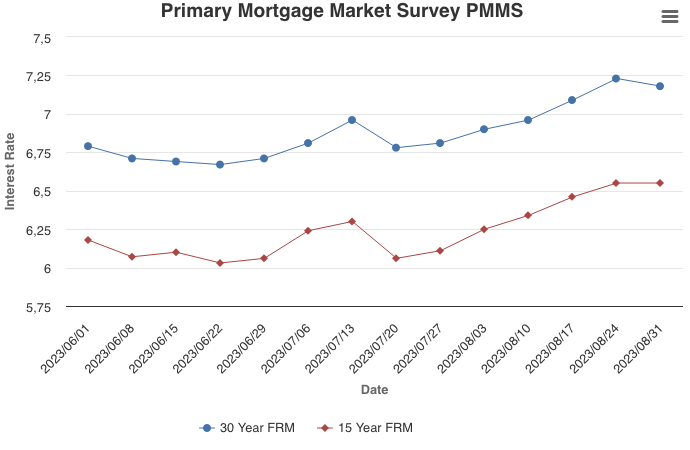

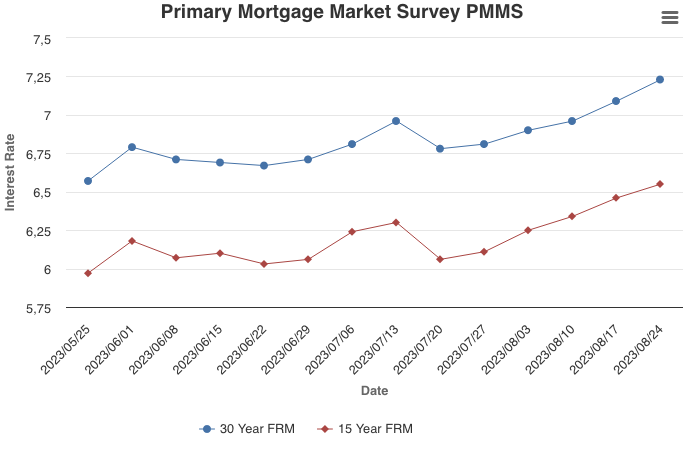

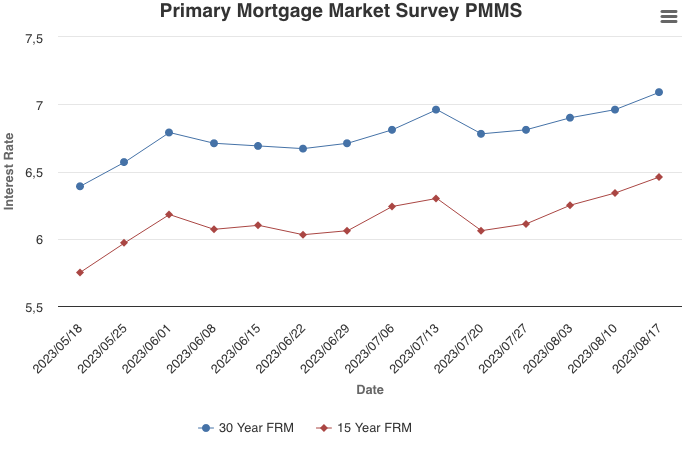

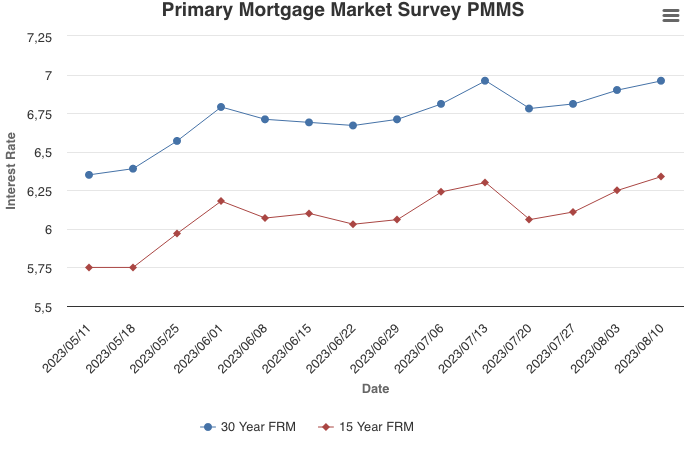

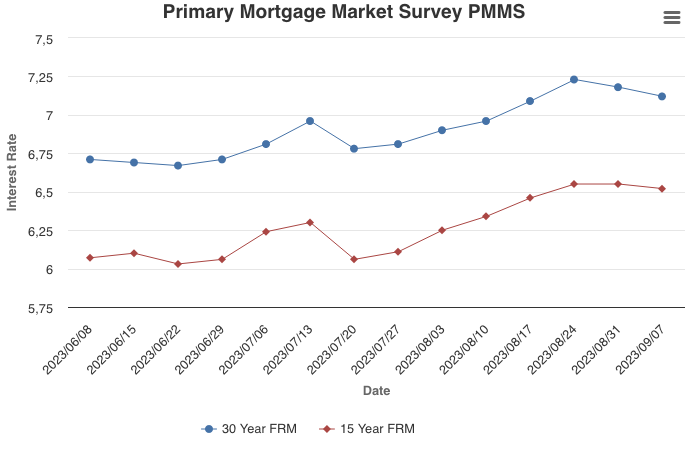

September 7, 2023

For the fourth consecutive week, the 30-year fixed-rate mortgage hovered above seven percent. The economy remains buoyant, which is encouraging for consumers. Though while inflation has decelerated, firmer economic data have put upward pressure on mortgage rates which, in the face of affordability challenges, are straining potential homebuyers.

Information provided by Freddie Mac.