![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/12/19120857/20191220-Share-Image-571x300.jpg)

Some Highlights:

- Interest rates will be lower than they have been since before 1980 at 3.8% and are projected to remain steady throughout 2020!

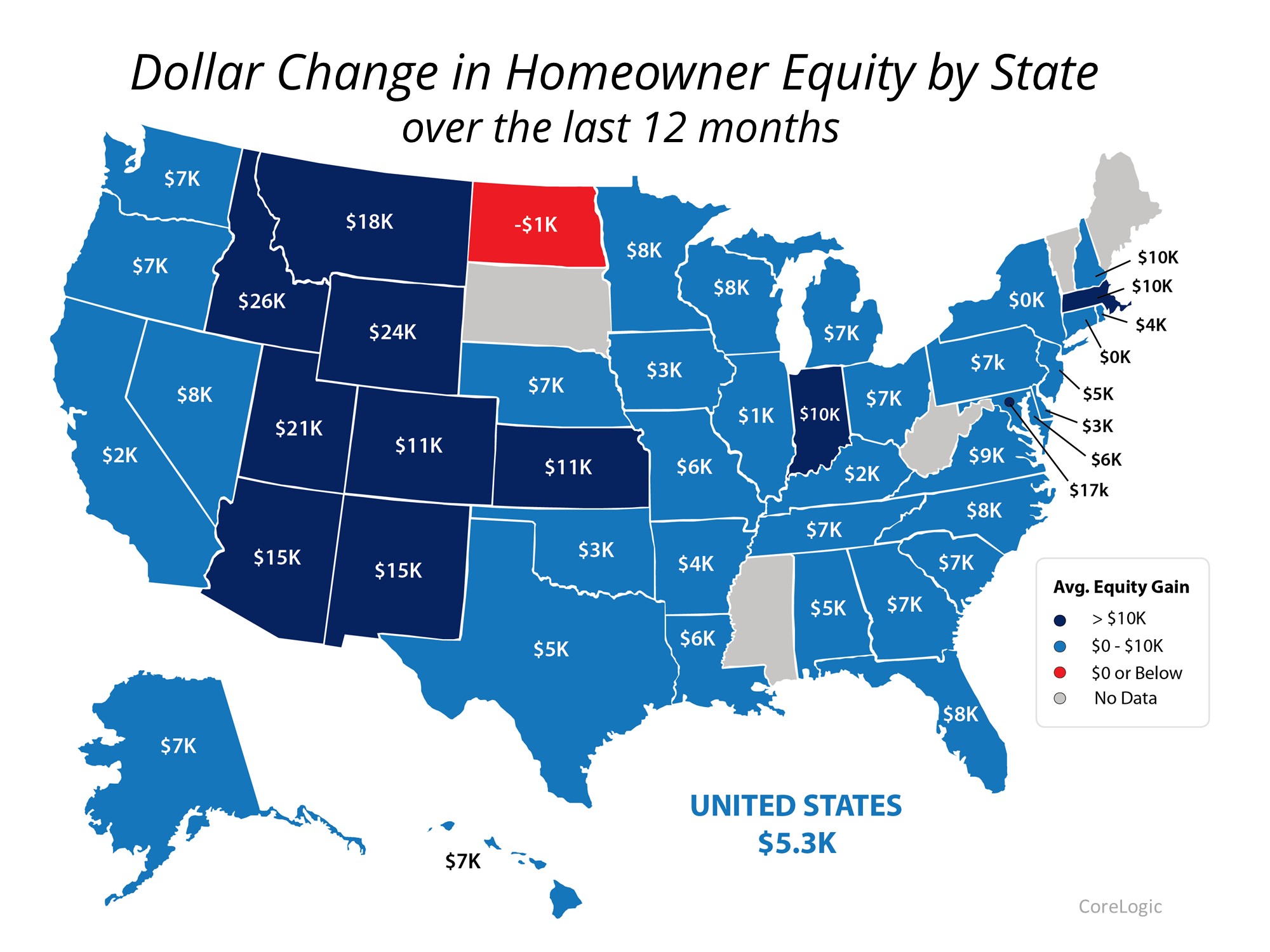

- According to CoreLogic, home prices will appreciate at a rate of 5.4% over the course of the year.

- Experts predict that the number of homes sold next year will be equal to or outpace 2019.

![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2019/12/19120754/20191220-MEM-scaled.jpg)